The Kessler Economy: Cascading Failures from Low Earth Orbit to the C-Suite

Space Junk, Stock Crashes, & Twitter: The Physics of Failure

Introduction: The Grammar of Collapse

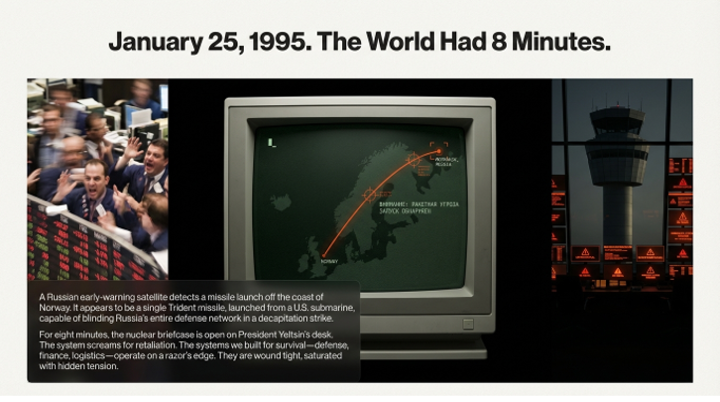

In one scenario, a defunct satellite collides with a rocket stage, atomizing both into a cloud of lethal shrapnel that begins a self-sustaining chain reaction, turning Low Earth Orbit into a minefield. In another, a pattern of mimetic trades builds to a speculative frenzy until a minor shock triggers a cascade of panic-selling, turning a market into a crater.

Though one is a problem of physics and the other of finance, they are governed by the same universal grammar of collapse. This essay argues that a common set of principles, rooted in self-organized criticality and feedback loops, dictates the dynamics of catastrophic failure in seemingly disparate complex systems. From orbital mechanics to financial markets and corporate structures, these collapses are rarely random "black swan" events. More often, they are endogenous—emerging from the system's own internal dynamics and the collective, often rational, behavior of its individual agents.

To understand this grammar, we will explore three distinct domains. First, we will analyze the physical model of collapse in space, the Kessler syndrome, as a tangible parable. Second, we will examine the mathematical models that reveal precursory signatures of financial crashes. Finally, we will turn to a recent, human-scale case study of organizational collapse to see these principles play out in the anthropology of the modern corporation.

--------------------------------------------------------------------------------

A Parable from Low Earth Orbit (LEO)

The Kessler Syndrome: A Tragedy of the Commons in Zero Gravity

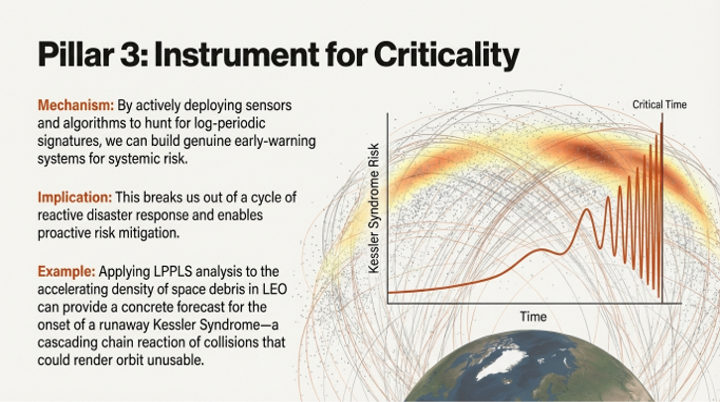

Coined by NASA scientist Donald J. Kessler in 1978, the Kessler syndrome describes a cascading "domino effect" in Low Earth Orbit (LEO). Each collision between objects generates a cloud of debris, which in turn increases the probability of more collisions, creating a self-sustaining feedback loop. Over time, this process could render LEO an unmanageably high-risk environment, threatening the vital infrastructure upon which modern society depends. Satellites are indispensable for telecommunications, global positioning, military operations, and crucial climate change monitoring, including tracking ice-sheet patterns and pollution.

The situation in LEO is a classic "tragedy of the commons." The benefits of launching a new satellite are individualized and captured by a single operator, but the risks and harms of the resulting debris are socialized among all users of the orbital domain. LEO thus becomes the quintessential laboratory for observing our central theme: a system where rational, individual actions aggregate into an irrational, collective catastrophe.

Quantifying the Cascade

The scale of the problem and its economic implications are staggering. The market for Space Traffic Management (STM)—the systems designed to mitigate these risks—is projected to be valued at USD 15.9 billion in 2025, reaching USD 44.9 billion by 2034 and growing at a compound annual growth rate of 12.2%.

The consequences are not merely theoretical, as the 1978 crash of the radioactive Soviet satellite Kosmos 954 over Canada's Dené lands demonstrated—a stark reminder that orbital risk is not abstract but has a terrestrial, human, and ecological cost. In 2009, an active Iridium communications satellite collided with a defunct Russian Cosmos satellite, generating two massive debris clouds and proving the orbital population is already dense enough for such events. The Kessler effect is defined by its point-of-no-return nature; once a certain density is reached, the cascade becomes self-perpetuating. Some analysts warn of "civilisation-ending effects," where the loss of orbital infrastructure could make humanity a "land-locked" species, vulnerable to existential risks without space-based technologies.

The Unilateral Imperative

Existing legal frameworks are ill-equipped, ad hoc, and often contradictory, making a coordinated international response difficult. Given the challenge of achieving consensus, some analyses suggest that a treaty-based approach is unrealistic in the necessary timeframe. Because international forums have hesitated to address the issue decisively, unilateral action by a capable nation may be the most appropriate and effective means of initiating debris removal, breaking the diplomatic stalemate.

--------------------------------------------------------------------------------

The Mathematics of Panic: Decoding Precursors to Financial Collapse

From Orbital Debris to Financial Avalanches

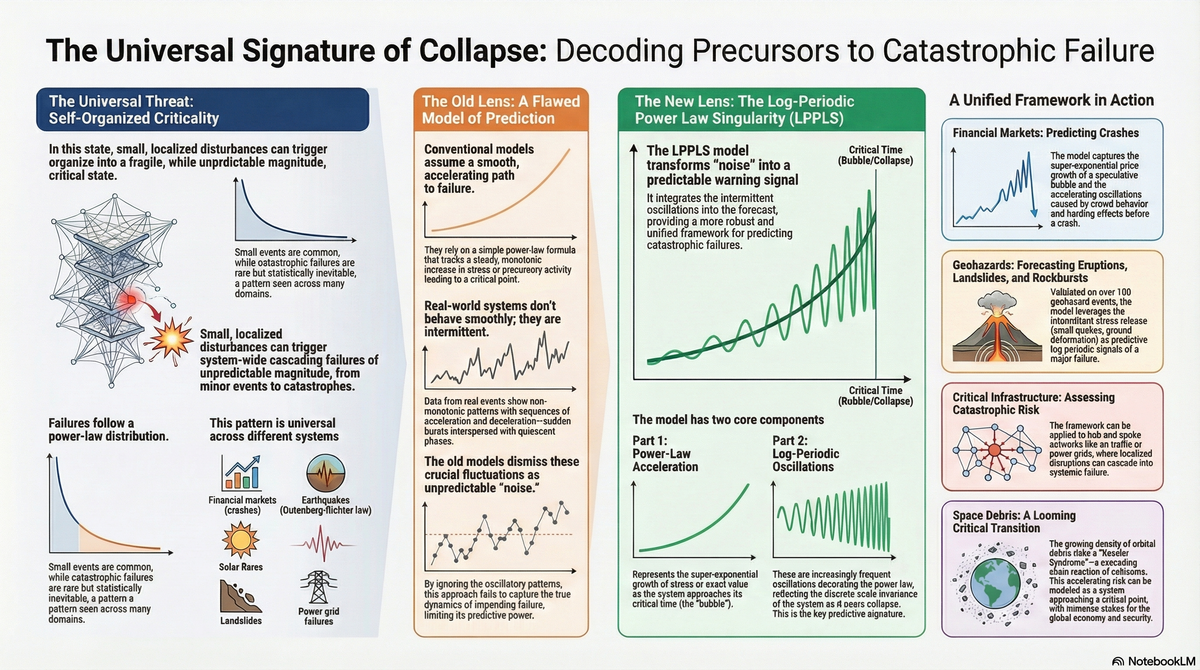

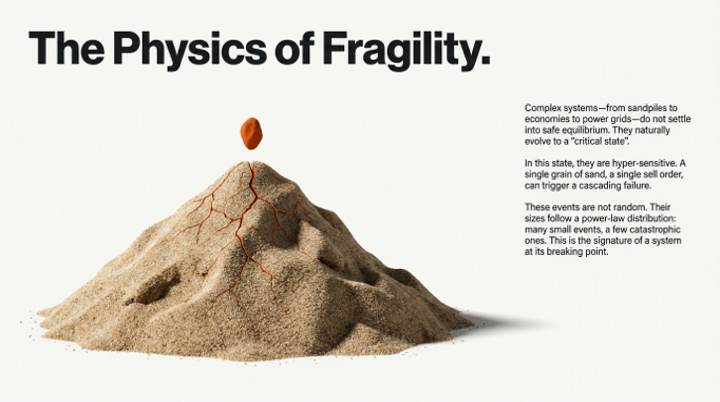

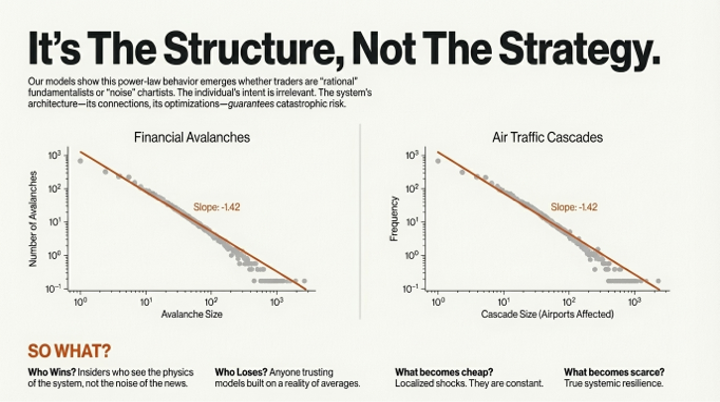

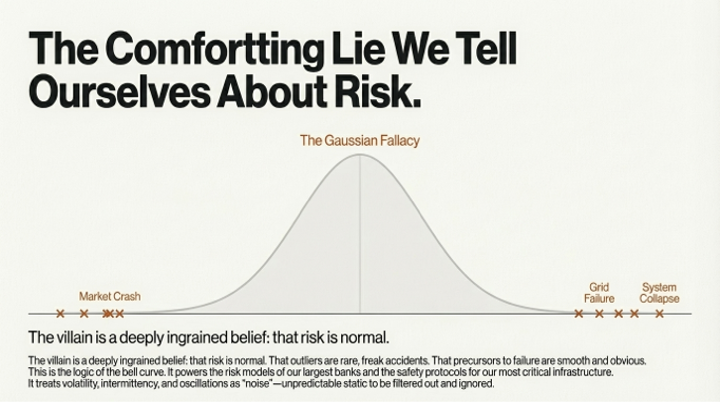

If the Kessler Syndrome is a cascade of physical fragmentation, a financial crash is a cascade of social fragmentation—the shattering of trust and consensus. In LEO, the accumulating "mass" is kinetic debris; in markets, it is speculative leverage and mimetic desire. Both systems load potential energy until a critical density is reached, whereafter the structure's own weight triggers its collapse. The theory of Self-Organized Criticality (SOC) provides a powerful lens for this analysis. SOC posits that complex systems, from earthquakes to financial markets, are driven by small, seemingly insignificant factors that produce "avalanches" of failure across a broad scale of magnitudes.

The core insight from SOC is that major crashes are often an endogenous result of the system's internal dynamics. They are not simply a reaction to large, external shocks but an emergent property of "crowd" behavior and agent interactions. The buildup of speculative leverage and imitative behavior can push a market toward a critical state, where a small trigger causes a disproportionately large collapse.

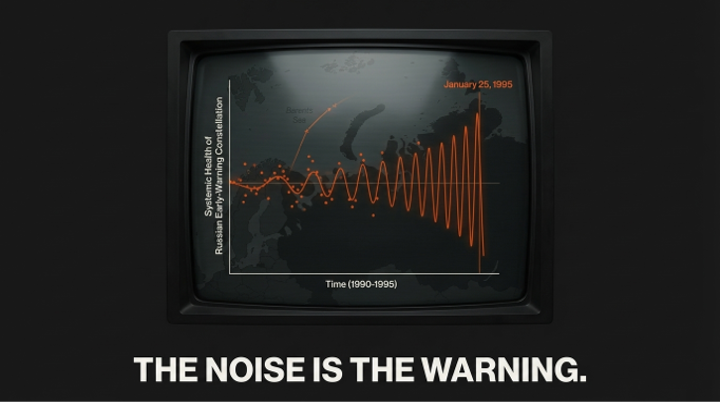

The Log-Periodic Power Law (LPPL) Signature

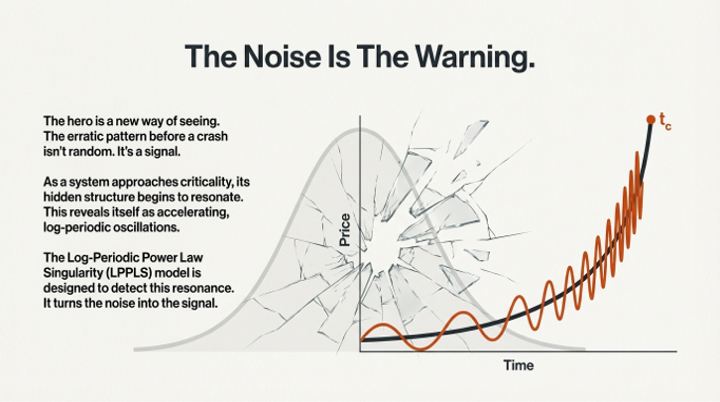

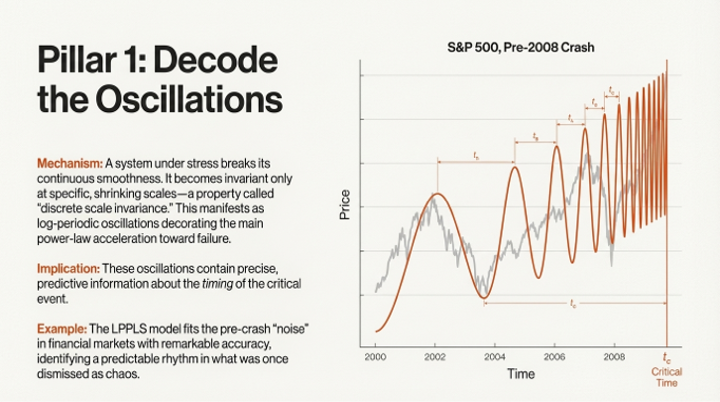

To identify a system's progression toward this critical state, researchers have developed mathematical tools like the Log-Periodic Power-Law (LPPL) model. The LPPL model identifies precursory patterns in financial time series, modeling a bubble as an accelerating power-law decorated with log-periodic oscillations, which are theorized to reflect the hierarchical structure of interacting market agents.

This distinctive signature has been studied in relation to numerous historical market events, including the crashes of 1929 and 1987, the 2008 global financial crisis, and the 2020 COVID-19 crash. However, the LPPL model is not a crystal ball. Its primary limitation is "parameter sloppiness." The critical time of the crash (t_c) is highly correlated with other parameters in the model, particularly those governing the oscillations. This is analogous to trying to focus an old projector with interconnected knobs; turning the "focus" knob also slightly changes the "brightness" and "tilt," making a perfectly sharp image impossible to isolate. The model can tell you a crash is probable, but the high correlation between the when(t_c) and the how (the oscillations) makes precise timing elusive.

The Leverage in Instability

The limitations of the LPPL model reveal a crucial strategic insight. The leverage is not in predicting the exact moment of collapse, but in recognizing the system's inherent structural fragility and its progression toward a critical state. The model's value lies in diagnosing instability, not timing its resolution. While mathematical models can reveal the how of a crash—the accelerating, oscillatory patterns of a system approaching a tipping point—understanding the why requires a deeper look at the human and organizational dynamics that drive the "crowd."

--------------------------------------------------------------------------------

The Anthropology of Collapse: A Case Study in Forced Criticality

The Twitter Takeover as a Systemic Shock

Shifting from quantitative models to qualitative observation, the 2022 acquisition of Twitter provides a real-time, human-scale experiment in systemic collapse. The new leadership's actions can be framed as a massive exogenous shock applied to a complex socio-technical system, forcing it toward a critical state. This shock was not the collapse itself, but the catalyst that exposed and accelerated the system's latent fragilities, triggering an entirely endogenous unraveling from within.

Cascading Failures in the Human Domain

An analysis of public discourse among former employees and industry observers reveals a multi-stage cascade, mirroring the dynamics seen in physical and financial systems.

- Destruction of Institutional Knowledge: The rapid departure of key leaders responsible for compliance with a 20-year consent decree with the Federal Trade Commission (FTC) created a sudden and massive institutional risk. Individual engineers were reportedly put in the position of having to "self-certify" that their work complied with the decree, a task for which they were not equipped and which exposed them to potential legal culpability. This was not merely a loss of personnel, but a deliberate dismantling of the organization's immune system, leaving it exposed to existential legal and regulatory threats.

- Forced Topological Shift: The abrupt ban on remote work was widely interpreted as a "constructive dismissal" tactic designed to force voluntary resignations. This policy had a predictable second-order effect: the most skilled and experienced employees—those with the most options in the job market—were the first to leave. This created a classic feedback loop of systemic degradation. As talent density decreased, the incentives for remaining talent to depart increased, accelerating the brain drain and ensuring the system shed its most adaptable and valuable components first.

- Applying the Wrong Model: Commentators argued that a management style suited for a manufacturing-heavy company like Tesla was fundamentally misapplied to a social network. This highlights a critical failure in systemic diagnosis: applying a mental model optimized for deterministic, physical systems (manufacturing) to a complex adaptive system where "understanding people and politics is the ONLY thing that matters." This echoed a past misstep, when an attempt to fully automate Tesla assembly in 2017 failed because robots were not ready for the finesse required in a noisy, real-world environment.

The Endogenous Unraveling

The Twitter case study serves as a potent example of a self-inflicted cascade. An initial, massive shock—the takeover and its subsequent policies—triggered an endogenous unraveling. This unraveling was not driven by irrationality, but by a series of rational individual decisions. Top talent, facing increased risk and undesirable working conditions, rationally chose to leave. The collective outcome of these individual decisions, however, was a negative one: the systemic degradation and increased risk of total failure for the organization.

--------------------------------------------------------------------------------

4. Conclusion: Designing for Anti-Fragility in a Critical World

From the physics of orbital debris to the mathematics of financial panic and the anthropology of corporate implosion, a common grammar of collapse is evident. Cascading failures, the tragedy of the commons, and the endogenous progression toward a critical state are principles that link the physical, financial, and organizational domains.

The primary strategic lesson is clear: if complex systems are inherently prone to catastrophic, cascading failure, then our focus must shift from attempting perfect prediction to designing systems for resilience. The goal is not just to be robust (able to withstand shocks) but to be anti-fragile—capable of absorbing shocks and emerging stronger. This requires building systems with redundancy, adaptability, and the capacity for graceful degradation rather than catastrophic collapse.

This imperative drives the development of practical, systemic risk management solutions. Technologies like AI-assisted air traffic control, ground-based lasers for debris removal, and intelligent transportation systems are not merely technical novelties; they are necessary components for managing complexity and mitigating cascading failures in our physical infrastructure.

The challenges of the 21st century thus demand a new archetype of leader: the Systems Anthropologist, a strategist capable of reading the universal grammar of collapse and, in doing so, building the anti-fragile systems that will define the landscape of tomorrow.